My simple answer is "probably not". Decision Moose is a proprietary asset allocation and market timing signal provided for free (will soon be a small monthly fee) by William Dirlam. I recently came across his web site and were amazed with his calls and his performance which published on his site. He uses technical analysis to time the ETF index funds with the objective of consistently outperforming the financial market averages and minimizing the risk.

From his transaction history page for the period between 5/7/2000 and 12/29/2009, he turned an initial investment of $100,000 into $957,796 within 10 years. It was an incredible number. For my curiosity, I did a back-testing using my favorite weekly moving average with added filters and see I could at least match his result. I used his preferred ILF index fund with data only available from late 2001. My first buy signal alert happened on 4/4/2003. It generated 3 buys and 2 sells with one remaining open position. With an initial hypothetical investment of $100,000, the realized profit is $482,331 and unrealized profit is $229,545. It resulted with a total profit of $711,876.

As most people know that back-testing or past performance is no guarantee of future results. But I am glad that I can use a simple moving average technique and other technical analysis filters as one of the tools for my investments.

(click the chart to enlarge)

This blog is about my stock market investment in stocks, bonds and ETFs. The investment strategy is to use the common technical analysis tools such as moving averages, RSI, and MACD etc to determine the trend of the markets and invest accordingly.

Tuesday, December 29, 2009

Monday, December 28, 2009

Swing Trade (simulated) created

Created a "Traders Pick" simulated swing trade position. This portfolio will consist one or more picks and can be a long or short position. Sideline or no trade will be in Cash. Holding period can be days or weeks. Trailing stop is 10%, however other stops will be considered such as moving average crossover to other the other direction and it may trigger the selling of the position before the 10% trailing stop.

10 Best & 10 Worst ETFs for the year of 2009

Richard Shaw, a managing principal of QVM Group has summarized the 10 Best & 10 Worst ETFs in 2009 via SeekingAlapha. The top 9 Best ETFs were up over 100% as of 12/24.

Here is the list:

"Excluding short funds and leveraged funds, what long funds had the highest total returns and lowest total returns in 2009 through December 24 (3 trading days remaining)?

Top Ten: (source: Morningstar)

We found some difficulty precisely identifying the worst losers. Not all were included in each database, and the databases did not agree on the YTD return. Therefore, we won’t provide the percent loss per fund, but will say that the losses ranged from over 55% (the gas funds) to over the low teens. In approximate order of worst to least worst, the ten top losers are:

Here is the list:

"Excluding short funds and leveraged funds, what long funds had the highest total returns and lowest total returns in 2009 through December 24 (3 trading days remaining)?

Top Ten: (source: Morningstar)

- KOL: 144.19% (coal companies)

- RSX: 140.19% (Russia)

- PKOL: 136.22% (coal companies)

- JJC: 130.39% (copper ETN)

- LD: 123.79% (lead ETN)

- EWZ: 118.99% (Brazil)

- SLX: 112.22% (steel companies)

- INP: 102.24% (India ETN)

- GML: 100.50% (emerging Latin America)

- XSD: 98.75% (semi-conductors)

We found some difficulty precisely identifying the worst losers. Not all were included in each database, and the databases did not agree on the YTD return. Therefore, we won’t provide the percent loss per fund, but will say that the losses ranged from over 55% (the gas funds) to over the low teens. In approximate order of worst to least worst, the ten top losers are:

- UNG (natural gas)

- GAZ (natural gas ETN)

- BBH (biotechnology)

- EDV (extended duration Treasuries)

- TLT (20+ yr Treasuries)

- PJB (banks)

- KRE (regional banks)

- GRN (carbon credits ETN)

- COW (livestock ETN)

- GRN (grain ETN)"

Saturday, December 26, 2009

ETF Winners Could Repeat In 2010

If the market trend continues heading the same direction, most of the ETF winners this year could repeat in 2010.

Here is an article by John Spence of MarketWatch - Dec 14, 2009

As the year draws to a close, here's a list of trends to watch in the ETF business for 2010:

1. Bonds -- Fixed-income ETFs came late to the party relative to stock funds, but they've been making up for lost time. As of Nov. 30, there were 802 ETFs in the U.S. overseen by 30 managers and a record $739 billion in total industry assets, according to State Street Global Advisors. Of these, 79 were fixed-income ETFs but they held almost $100 billion in assets. After the credit crunch, more investors are playing defense with bonds. Vanguard and Pimco are launching more bond ETFs, which should only increase the visibility of the fixed-income side of the business in 2010.

2. BlackRock, Vanguard rising -- BlackRock Inc. BLK is the largest ETF manager after its acquisition this year of Barclays Global Investors, followed by State Street Corp. STT . Meanwhile, Vanguard Group has been growing rapidly. Its ETF inflows topped $26 billion for the year through November to take total assets to almost $90 billion. Vanguard is the third-largest ETF provider. BlacRock's integration of BGI and its ETFs is another story to watch next year.

3. Consolidation - Despite the ETF business' continued impressive growth, assets remain concentrated at the largest funds and providers. Many smaller funds are struggling to attract assets and trading volume, and more may be forced to close next year. Almost 100 ETFs have been liquidated since the end of 2007, according to Morgan Stanley. "The challenging market environment has limited flows into many of the newer ETFs, particularly those with a narrow focus based on less well-known indexes," it said.

4. Emerging markets - ETF investors had a clear preference for international stocks over U.S. companies in 2009. In particular, they shoveled money at emerging markets ETFs such as Vanguard MSCI Emerging Markets ETF VWO and iShares MSCI Emerging Markets Index EEM Fund. Yet the recent debt scare in Dubai is a clear warning of the risks and volatility of emerging markets."

(for more details, click here)

Here is an article by John Spence of MarketWatch - Dec 14, 2009

"BOSTON (MarketWatch) -- Exchange-traded fund buyers plowed money into ETFs tracking bonds and international stocks this year, and the pattern looks set to continue in 2010 as investors diversify portfolios, protect against losses and chase the hot performance of emerging markets.

This past year was a record for bond ETFs, with investors flocking to a growing number of fixed-income offerings. Through the end of November, taxable-bond ETFs had net inflows of more than $32 billion, the most among the major asset classes, according to investment researcher Morningstar Inc.As the year draws to a close, here's a list of trends to watch in the ETF business for 2010:

1. Bonds -- Fixed-income ETFs came late to the party relative to stock funds, but they've been making up for lost time. As of Nov. 30, there were 802 ETFs in the U.S. overseen by 30 managers and a record $739 billion in total industry assets, according to State Street Global Advisors. Of these, 79 were fixed-income ETFs but they held almost $100 billion in assets. After the credit crunch, more investors are playing defense with bonds. Vanguard and Pimco are launching more bond ETFs, which should only increase the visibility of the fixed-income side of the business in 2010.

2. BlackRock, Vanguard rising -- BlackRock Inc. BLK is the largest ETF manager after its acquisition this year of Barclays Global Investors, followed by State Street Corp. STT . Meanwhile, Vanguard Group has been growing rapidly. Its ETF inflows topped $26 billion for the year through November to take total assets to almost $90 billion. Vanguard is the third-largest ETF provider. BlacRock's integration of BGI and its ETFs is another story to watch next year.

3. Consolidation - Despite the ETF business' continued impressive growth, assets remain concentrated at the largest funds and providers. Many smaller funds are struggling to attract assets and trading volume, and more may be forced to close next year. Almost 100 ETFs have been liquidated since the end of 2007, according to Morgan Stanley. "The challenging market environment has limited flows into many of the newer ETFs, particularly those with a narrow focus based on less well-known indexes," it said.

4. Emerging markets - ETF investors had a clear preference for international stocks over U.S. companies in 2009. In particular, they shoveled money at emerging markets ETFs such as Vanguard MSCI Emerging Markets ETF VWO and iShares MSCI Emerging Markets Index EEM Fund. Yet the recent debt scare in Dubai is a clear warning of the risks and volatility of emerging markets."

(for more details, click here)

Thursday, December 24, 2009

Monday, December 21, 2009

S&P 500 Signal still holds

According to the weekly chart, the signal indicated that it is still trending above the MA-18 and MA-39 lines, the current position is still the same - Long.

(click the to enlarge)

(click the to enlarge)

Saturday, December 19, 2009

Mark Mobius' view on Emerging Markets in 2010

Mark Mobius was interviewed by Frederik Balfour of Hong Kong-based correspondent of Business Week by phone on questions about his view on Emerging Markets in 2010.

"Mark Mobius is a legend among emerging-market investors. For more than 30 years, the 73-year-old fund manager, who oversees $33 billion spread across 35 Franklin Templeton funds, has scouted for investment opportunities in unlikely places. His U.S.-listed Templeton Emerging Markets Fund (NYSE:EMF - News)had a 109% return as of Dec. 14, compared with 73% for the MSCI Emerging Markets Index. Hong Kong-based correspondent Frederik Balfour caught up with Mobius by phone as the fund manager was visiting Doha, Qatar -- one stop on an itinerary that included Dubai, Lebanon, Saudi Arabia, and Libya.

Q: How do you expect emerging markets to perform in 2010?

A: You cannot expect the same kind of percentage increases, but that doesn't mean you can't have a very good return. We are not in the mode of selling massively or getting into cash, that's for sure. That's probably the consensus opinion, which is usually dangerous. But we are finding companies with good dividend yields, companies that are growing.

Q: What was behind the huge runup in emerging markets in 2009?

A: With the subprime shock, everybody was looking for safety. And for some strange reason, they thought the U.S. dollar was safe and went into money market funds until January or February of 2009. Then people began to wake up to a few things. One was that the supply of currency would at some time outpace demand, so value would decrease. In China there was 21% growth of money supply, and in the U.S. 18% to 20%. That created this incredible liquidity looking for a home as people woke up (to the fact) that they should think about inflation coming down the pike. They weren't getting any yield on dollar deposits, so equities were the obvious answer.

Q: Have emerging markets moved too far too fast?

A: The percentage increases are a bit misleading because you are coming from a low base. We are only halfway toward the previous high of 1997. Have we gone too far? The only measure we have is valuations, and probably the best single measure is price-to-book value ratio. (Book value is a measure analysts use to estimate what a share of stock would be worth if all the company's tangible assets -- factories, real estate, and so on -- were liquidated.) If you look at the average price-to-book ratio based on the stocks in the MSCI Emerging Markets Index, we are only halfway to the 1997 high. The absolute high was three times book, the low was one times book, and now we are at two times book, roughly."

(click this link from Yahoo finance for detailed info)

"Mark Mobius is a legend among emerging-market investors. For more than 30 years, the 73-year-old fund manager, who oversees $33 billion spread across 35 Franklin Templeton funds, has scouted for investment opportunities in unlikely places. His U.S.-listed Templeton Emerging Markets Fund (NYSE:EMF - News)had a 109% return as of Dec. 14, compared with 73% for the MSCI Emerging Markets Index. Hong Kong-based correspondent Frederik Balfour caught up with Mobius by phone as the fund manager was visiting Doha, Qatar -- one stop on an itinerary that included Dubai, Lebanon, Saudi Arabia, and Libya.

Q: How do you expect emerging markets to perform in 2010?

A: You cannot expect the same kind of percentage increases, but that doesn't mean you can't have a very good return. We are not in the mode of selling massively or getting into cash, that's for sure. That's probably the consensus opinion, which is usually dangerous. But we are finding companies with good dividend yields, companies that are growing.

Q: What was behind the huge runup in emerging markets in 2009?

A: With the subprime shock, everybody was looking for safety. And for some strange reason, they thought the U.S. dollar was safe and went into money market funds until January or February of 2009. Then people began to wake up to a few things. One was that the supply of currency would at some time outpace demand, so value would decrease. In China there was 21% growth of money supply, and in the U.S. 18% to 20%. That created this incredible liquidity looking for a home as people woke up (to the fact) that they should think about inflation coming down the pike. They weren't getting any yield on dollar deposits, so equities were the obvious answer.

Q: Have emerging markets moved too far too fast?

A: The percentage increases are a bit misleading because you are coming from a low base. We are only halfway toward the previous high of 1997. Have we gone too far? The only measure we have is valuations, and probably the best single measure is price-to-book value ratio. (Book value is a measure analysts use to estimate what a share of stock would be worth if all the company's tangible assets -- factories, real estate, and so on -- were liquidated.) If you look at the average price-to-book ratio based on the stocks in the MSCI Emerging Markets Index, we are only halfway to the 1997 high. The absolute high was three times book, the low was one times book, and now we are at two times book, roughly."

(click this link from Yahoo finance for detailed info)

Thursday, December 17, 2009

Why don't they have a regulation to stop it

Apparently the interest rate on most of the credit cards are going higher and higher these days even though you pay in full each month. Have you heard about the 79.9% interest rate on credit card? Here is the story from USA Today by Candice Choi, Associated Press. 12-17-2009:

"NEW YORK — It's no mistake. This credit card's interest rate is 79.9%.

The bloated APR is how First Premier Bank, a subprime credit card issuer, is skirting new regulations intended to curb abusive practices in the industry. It's a strategy other subprime card issuers could start adopting to get around the new rules.

Typically, the First Premier card comes with a minimum of $256 in fees in the first year for a credit line of $250. Starting in February, however, a new law will cap such fees at 25% of a card's credit line.

In a recent mailing for a preapproved card, First Premier lowers fees to just that limit — $75 in the first year for a credit line of $300. But the new law doesn't set a cap on interest rates. Hence the 79.9 APR, up from the previous 9.9%.

"It's the highest on the market. It's the highest we've ever seen," said Anuj Shahani, an analyst with Synovate, a research firm that tracks credit card mailings.

The terms are eyebrow raising, but First Premier targets people with bad credit who likely can't get approved for cards elsewhere. It's a group that tends to lean heavily on credit too, meaning they'll likely incur steep financing charges. So for a $300 balance, a cardholder would pay $20 a month in interest."

Wednesday, December 16, 2009

Risky Business for Buy and Hold Investors

Long-term investors would have some recent painful experiences both in early 2000, 2008 and early 2009. One would argue that it still is a good strategy in a long run. It may be true, however if there are certain simple strategies that could avoid some of the ugly down turns, why not exploit it and use it.

ETF guru Tom Lydon of ETF Trends said the following (12-16-2009):

"If you’re a long-term investor, you may have lost a good chunk of your wealth in the market’s crash. It’s because of this that the buy-and-hold mantra is softening to a whisper, and another strategy to use in conjunction with exchange traded funds (ETFs) is supplanting it. The S&P 500 has declined about 25% since January 2000 (11% when dividends are factored in). The Barclays Capital Index of Treasury bonds has delivered 85%, including capital gains and interest, and an index monitoring 30-year Treasuries produced a total return of 116% in the past 10 years, writes Michael Mackenzie for The Financial Times.

Analysts believe this “lost decade” for equities came after the bull market of the 1990s. Alan Ruskin, strategist at RBS Securities, sees that the “sheer volatility was very hard for buy-and-hold investors to stomach.” Stocks weren’t able to meet the overly optimistic profit expectations that ended in early 2000, which lead to reduced interest rates. [Why buy-and-hold is dead.]

The interest rate cuts and easing of inflationary fears bolstered government bonds. The current 10-year Treasury yields is around 3.5% is quite low as compared to the February 2000 10-year note with 6.5%. Ruskin thinks that bonds, which are at relatively low yields, may not beat out equities unless a round of deflation emerges.

The buy-and-hold method has worked in the past, but many investors have learned a painful lesson after the last two recessions: hanging on for dear life can result not only in lost money, but lost time. Is the answer found in hiding from equities? Not necessarily. There are lots of uptrends out there – it’s just a matter of learning to spot them and, most importantly, act on them.

If investors can follow a simple discipline that has a higher probability of success, they’ll be motivated to do it. That’s why we use the 200-day moving average strategy. It’s easy to implement and simple to track. For a more detailed explanation of the strategy and to learn more, take a look at our book: The ETF Trend Following Playbook." (click here for more details)

ETF guru Tom Lydon of ETF Trends said the following (12-16-2009):

"If you’re a long-term investor, you may have lost a good chunk of your wealth in the market’s crash. It’s because of this that the buy-and-hold mantra is softening to a whisper, and another strategy to use in conjunction with exchange traded funds (ETFs) is supplanting it. The S&P 500 has declined about 25% since January 2000 (11% when dividends are factored in). The Barclays Capital Index of Treasury bonds has delivered 85%, including capital gains and interest, and an index monitoring 30-year Treasuries produced a total return of 116% in the past 10 years, writes Michael Mackenzie for The Financial Times.

Analysts believe this “lost decade” for equities came after the bull market of the 1990s. Alan Ruskin, strategist at RBS Securities, sees that the “sheer volatility was very hard for buy-and-hold investors to stomach.” Stocks weren’t able to meet the overly optimistic profit expectations that ended in early 2000, which lead to reduced interest rates. [Why buy-and-hold is dead.]

The interest rate cuts and easing of inflationary fears bolstered government bonds. The current 10-year Treasury yields is around 3.5% is quite low as compared to the February 2000 10-year note with 6.5%. Ruskin thinks that bonds, which are at relatively low yields, may not beat out equities unless a round of deflation emerges.

The buy-and-hold method has worked in the past, but many investors have learned a painful lesson after the last two recessions: hanging on for dear life can result not only in lost money, but lost time. Is the answer found in hiding from equities? Not necessarily. There are lots of uptrends out there – it’s just a matter of learning to spot them and, most importantly, act on them.

If investors can follow a simple discipline that has a higher probability of success, they’ll be motivated to do it. That’s why we use the 200-day moving average strategy. It’s easy to implement and simple to track. For a more detailed explanation of the strategy and to learn more, take a look at our book: The ETF Trend Following Playbook." (click here for more details)

South Korea's ETF looks good

The Korea iShares EWY tracks the Morgan Stanley Capital International Index of the South Korean stock market. The EWY contains 18% of the Samsung Electronics. For sector holding, it has over 22% in industrial materials, over 21% in hardware and over 18% in financial services according to the Yahoo Finance portal.

Tom Lydon of ETFTrend.com (12-16-2009) stated that there are 7 reasons to feel good about South Korea's ETF.

"After the devastation brought on by the financial crisis, the South Korean economy, along with its related exchange traded fund (ETF), has been strengthening on fiscal stimulus and the government’s expansionary policies. The South Korean economy was able to climb out of its recession, expanding for three consecutive quarters, reports Kim Yoon-mi for The Korea Herald. Other reasons to like what South Korea is doing right now include:

Tom Lydon of ETFTrend.com (12-16-2009) stated that there are 7 reasons to feel good about South Korea's ETF.

"After the devastation brought on by the financial crisis, the South Korean economy, along with its related exchange traded fund (ETF), has been strengthening on fiscal stimulus and the government’s expansionary policies. The South Korean economy was able to climb out of its recession, expanding for three consecutive quarters, reports Kim Yoon-mi for The Korea Herald. Other reasons to like what South Korea is doing right now include:

- The Ministry of Strategy and Finance revised up its growth forecast for the year to 0.25% and increased next year’s growth outlook to 5%. (Ways to get in on South Korea’s expansion).

- Since April, the South Korean won has been steadily appreciating, gaining strength on the rising current account surpluses and the increase in overseas investors.

- The nation’s external debts and short-term overseas borrowings have both decreased from an year earlier.

- The surge in foreign investors has brought a swift recovery to the local stock market, with overseas investors net-buying $24 billion worth of stocks in the first 11 months of 2009 after suffering from a net-sale of $30 billion worth of stocks in 2008, according to financial industry data."

- (click here for more detials)

Tuesday, December 15, 2009

ETF Investing Based on Popluation Trends

Trang Ho of Yahoo Finance has written an article (Dec 14, 2009) :

"Consumer spending makes up 70% of the U.S. economy. So studying people and where they are in their lives can provide a crystal ball for what's going to happen in the economy years ahead of time, according to HS Dent, a financial research firm founded by economist Harry Dent.

Rodney Johnson, president of HS Dent, applies the theory behind the Dent Method to actively manage Dent Tactical ETF's (NYSEArca:DENT - News) portfolio of other ETFs.

Since it started trading Sept. 16, the fledgling ETF has lost 4% while the S&P 500 has gained 4%. An older portfolio following the same strategy but offered through variable annuities shows more promise: It's down 5% since May 1, 2008, vs. the S&P 500's 21% fall."

(click here for more details)

"Consumer spending makes up 70% of the U.S. economy. So studying people and where they are in their lives can provide a crystal ball for what's going to happen in the economy years ahead of time, according to HS Dent, a financial research firm founded by economist Harry Dent.

Rodney Johnson, president of HS Dent, applies the theory behind the Dent Method to actively manage Dent Tactical ETF's (NYSEArca:DENT - News) portfolio of other ETFs.

Since it started trading Sept. 16, the fledgling ETF has lost 4% while the S&P 500 has gained 4%. An older portfolio following the same strategy but offered through variable annuities shows more promise: It's down 5% since May 1, 2008, vs. the S&P 500's 21% fall."

(click here for more details)

Sunday, December 13, 2009

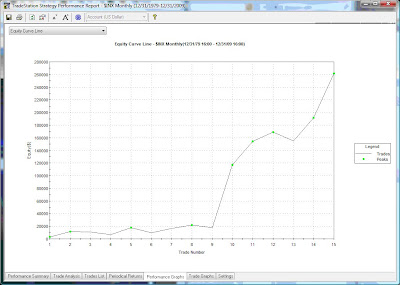

How does it look with the Ivy Portfolio strategy

Mebane Faber and Eric Richardson had published a book named "The Ivy Portfolio: How to invest like the top endowments and avoid bear markets". Even though the endowments of some top Ivy League schools were not doing so well in 2008, the strategy of using moving average described in the book has its merit and the strategy has been widely followed by others.

The strategy utilizes a 10-month Simple Moving Average or a 10-month Exponential Moving Average to determine if the underline equity a buy or a sell. At the end of each month, if the closing price of the selected equity is above the 10-M SMA or 10-M EMA, then this equity is a buy. Otherwise, if the price closes below these moving averages, it is a sell. It's that simple.

I ran a back-testing using TradeStation. Here were the setup and the result:

Setup:

1. Ticker: $INX - S&P 500

2. 10-M SMA

3. Duration: 1979 to Nov 2009 (30 years)

4. Position size: 200 shares

Result from TradeStation back-testing:

1. Total trades: 15

2. Number of winning trades: 10

3. Number of losing trades: 5

4. Percent Profitable: 66.67%

5. Total net profit: $261,800

This strategy works very well in my opinion if discipline can be enforced and not to worry about the daily and weekly price movement. It is worth for further investigation for you all.

(click the chart to enlarge)

The strategy utilizes a 10-month Simple Moving Average or a 10-month Exponential Moving Average to determine if the underline equity a buy or a sell. At the end of each month, if the closing price of the selected equity is above the 10-M SMA or 10-M EMA, then this equity is a buy. Otherwise, if the price closes below these moving averages, it is a sell. It's that simple.

I ran a back-testing using TradeStation. Here were the setup and the result:

Setup:

1. Ticker: $INX - S&P 500

2. 10-M SMA

3. Duration: 1979 to Nov 2009 (30 years)

4. Position size: 200 shares

Result from TradeStation back-testing:

1. Total trades: 15

2. Number of winning trades: 10

3. Number of losing trades: 5

4. Percent Profitable: 66.67%

5. Total net profit: $261,800

This strategy works very well in my opinion if discipline can be enforced and not to worry about the daily and weekly price movement. It is worth for further investigation for you all.

(click the chart to enlarge)

Saturday, December 12, 2009

EFA - International Index Fund still looks good

As EFA closed at 55.47 on 12-11-2009, the MA-4 still stays above the MA-18 line. Both Ocean and TSP portfolios continue to be long on EFA.

(click the chart to enlarge)

(click the chart to enlarge)

Experiment with the Portfolio Spreadsheet

Experimental Portfolio Spreadsheet

I re-created 2 Portfolios. One port is Ocean Portfolio and the other is TSP Portfolio using Google Spreadsheet. It works quite well for me and I think I can monitor my simulated portfolios without being forced to use Facebook by KaChing. If I find something better online for portfolio tracking and it's free, then I will make the switch. As of now, it serves my needs.

Both portfolios will have $100,000 as an initial simulated cash investment. Ocean Portfolio will continue to be trend trading using ETF in either direction (Long or Inverse). TSP Portfolio will trade the government TSP equivalent index funds such as SPY(C), EFA(I), AGG(F) and IWM(S). IWM is Russell 2000 Index fund and it is not really the S Fund equivalent but I chose IWM because of its high trading volume. TSP portfolio will be traded in Long position because of its restriction.

I initiated both portfolios at the close of 12-11-2009 and these are 100% invested based on the 39-week moving average charts.

I re-created 2 Portfolios. One port is Ocean Portfolio and the other is TSP Portfolio using Google Spreadsheet. It works quite well for me and I think I can monitor my simulated portfolios without being forced to use Facebook by KaChing. If I find something better online for portfolio tracking and it's free, then I will make the switch. As of now, it serves my needs.

Both portfolios will have $100,000 as an initial simulated cash investment. Ocean Portfolio will continue to be trend trading using ETF in either direction (Long or Inverse). TSP Portfolio will trade the government TSP equivalent index funds such as SPY(C), EFA(I), AGG(F) and IWM(S). IWM is Russell 2000 Index fund and it is not really the S Fund equivalent but I chose IWM because of its high trading volume. TSP portfolio will be traded in Long position because of its restriction.

I initiated both portfolios at the close of 12-11-2009 and these are 100% invested based on the 39-week moving average charts.

Friday, December 11, 2009

Ocean Portfolio at KaChing will be deleted

I will delete the Ocean Portfolio, TSP Portfolio and Trader Portfolio accounts from KaChing as a result of being forced to move to Facebook.

KaChing moved my portfolio to Facebook

I got the message from Kaching.com which they indicated that I can't no longer use their site to track my portfolio but instead they redirected me to Facebook. Personally I would not use Facebook for my portfolio tracking. I will figure how to track my portfolio in the next few days without KaChing. From their blog, I already saw a lot of unhappy users expressing their discontent comments.

Here is the message from KaChing:

"We are migrating your virtual portfolio to our Investing IQ App on Facebook.

In case you were not aware, kaChing has evolved into a marketplace where you can find great investors to emulate by mirroring their trades in your own kaChing brokerage account.

In order to avoid confusion between the marketplace and our virtual investing environment, we have decided to dedicate kaching.com solely to the marketplace and our Facebook app (now called the Investing IQ App) to virtual portfolios.

If you would like to continue to manage your virtual portfolio, then please click on the link below, which will migrate your virtual portfolio from kaching.com to Facebook.

Don't have a Facebook account yet? No problem. This link will allow you to create a Facebook account and immediately access your existing virtual portfolio.

Please email us at support@kaching.com if you have any questions.

Thanks,

The kaChing Team"

Here is the message from KaChing:

"We are migrating your virtual portfolio to our Investing IQ App on Facebook.

In case you were not aware, kaChing has evolved into a marketplace where you can find great investors to emulate by mirroring their trades in your own kaChing brokerage account.

In order to avoid confusion between the marketplace and our virtual investing environment, we have decided to dedicate kaching.com solely to the marketplace and our Facebook app (now called the Investing IQ App) to virtual portfolios.

If you would like to continue to manage your virtual portfolio, then please click on the link below, which will migrate your virtual portfolio from kaching.com to Facebook.

Don't have a Facebook account yet? No problem. This link will allow you to create a Facebook account and immediately access your existing virtual portfolio.

Please email us at support@kaching.com if you have any questions.

Thanks,

The kaChing Team"

Wednesday, December 9, 2009

The Beauty of Weekly Charts

The beauty of using weekly chart is to eliminate the frustration of a single day or a few consecutive days of market volatile price movement. As the Dow dropped 104 points and S&P500 dropped more than 11 points yesterday, the weekly chart did not react as bad as it sounds. I would worry if it continued to drop in a few consecutive weeks as it did in early 2008. But until then, I would not do anything yet. As the chart shows below, the blue dots located at the top the price bars representing the 52-week closing high. There are more blue-dot bars than the non blue-dot bars in the last 4 months. So I will let the trend run until it shows sign of reversing before I consider doing some adjustment of the portfolio.

(click the chart to enlarge)

(click the chart to enlarge)

Sunday, December 6, 2009

SPY weekly chart still shows sign of strength

A friend of mine who follows my blog and concerned about the markets may be pulling back in the near future. My answer to him was that if it happened then I will get out but I will not do anything until the charts tell me. I found that it is important to have a strategy on any investments and even more important to have a confidence to stick with the strategy and let the strategy aid your decision.

The SPY (S&P500 Index) weekly closed at 111.26 as of 12/04/2009. Its MA-4 is 109.88, MA-18 is 105.74 and MA-39 is 96.79. From observation, the general market still has strength to stay its course.

(click here to enlarge)

The SPY (S&P500 Index) weekly closed at 111.26 as of 12/04/2009. Its MA-4 is 109.88, MA-18 is 105.74 and MA-39 is 96.79. From observation, the general market still has strength to stay its course.

(click here to enlarge)

Friday, December 4, 2009

ETF Assests Hit A New Record in November

More cash from the sidelines had been poured back into the markets and ETF assets hit a new record in November. Here is the ETF Flows Report written by Matt Hougan of IndexUniverse

| "Written by Matt Hougan - December 03, 2009 16:11 PM November ETF Assests Hit Record Levels |

| Related ETFs: EEM/IWM /LQD/SPY/SSO/TIP/UNG/UUP/VB/VWO |

| Investors poured $17.5 billion in new cash into exchange-traded funds and exchange-traded notes in November, according to new data released from the National Stock Exchange, pushing total assets under management in the Year-to-date, investors have poured $89.7 billion in new cash into various exchange-traded products; down from $132 billion for the first 11 months of 2008, but a strong showing nonetheless. Most of the inflows were into ETFs, which gathered $17.1 billion, and now have $743 billion in assets under management. ETNs gained $354 million in new flows; combined with market returns, that brought their total AUM to $8.2 billion. Interestingly, Vanguard led all ETF issuers for inflows in November, pulling down $5.4 billion in new assets. BlackRock Global Investors was second, with $4.2 billion in assets, followed by State Street Global Advisors, at $3.7 billion. Inflows By Asset Class: Long-Only ETFs Inflows were seen in all major long-only asset classes save real estate in November. International equities led the way with $5 billion in inflows, followed by fixed income with $4.8 billion. Year-to-date, fixed income leads all comers, with $39.4 billion in inflows, followed by international equities and commodities at $29.3 billion and $28.8 billion, respectively. Click here for more details. |

Tuesday, December 1, 2009

ETF profits may result in higher taxes

Some ETF funds are taxed as an ordinary income-tax rates even if you hold it as a long-term investment. (more than 1 year and 1 day). Here is an interesting article:

By John Waggoner, USA TODAY (12/1/2009)

Investors in some exchange traded funds might be getting a little something extra this year: a bigger tax bill.

Profits from the vast majority of mutual funds get taxed at capital gains rates, just as profits from stocks and bonds. Long-term capital gains are taxed at a maximum 15%.

But long-term profits from funds that invest in gold or silver bullion are taxed at the same rate as gains from gold bars and other collectibles: 28%.

Stocks, mutual funds and collectibles must be held for a year or more to qualify for long-term rates. Otherwise, they're taxed as income at the same rate as wages – a maximum 35%.

The logic: Fund profits get taxed at the same rate as the underlying investment.

Just as gains from stock funds are treated the same as profits from the stocks themselves, profits from exotic ETFs are taxed the same as their investments.

ETF dividends may confuse you at tax time

When it comes to tax time, you may wonder how ETF dividends will be filed. Here is an article from Matt Karntz of USA Today which it may give you some clearer answer.

"By Matt Krantz, USA TODAY (2/18/2009)

Q: Are the dividends from exchange-traded (ETF) funds like DIA or SPY considered to be "qualified dividends" for tax purposes?

A: There are two main types of dividends. And that difference becomes very important at tax time.

I'm oversimplifying things. But essentially, dividends paid out of earnings by U.S. corporations are considered so-called qualified dividends. These dividends are eligible for, or qualify for, a lower tax rate that matches your long-term capital gains tax. The maximum tax rate on qualified dividends is 15%, as you can read here.

If dividends aren't qualified, then they may be taxed at your ordinary income tax rate. That's generally higher than 15%, sometimes by a considerable amount. Click this link for more details"

Saturday, November 28, 2009

Become Your Own Portfolio Manager

There may be a good reason for people who want to be their own portfolio managers. Here is an article that may guide you to the right step.

"Ron DeLegge, Editor (Nov 25, 2009)

SAN DIEGO (ETFguide.com) - Everyday more and more people are making a choice they never thought they would make: To become the manager of their own investments.

Among the top reasons for self-directing one's investments are greater control and flexibility. But there's one other very good reason for becoming your own portfolio manager: The potential for better performance.

Many academic studies show that during both good and bad times the vast majority of Wall Street's portfolio managers consistently underperform versus corresponding benchmark indexes. However, making the decision to supervise your own investments won't necessarily guarantee better results. To avoid the same type of market underperformance that characterizes most of Wall Street, you'll need to build your investments on the right foundation. Click here for more details."

"Ron DeLegge, Editor (Nov 25, 2009)

SAN DIEGO (ETFguide.com) - Everyday more and more people are making a choice they never thought they would make: To become the manager of their own investments.

Among the top reasons for self-directing one's investments are greater control and flexibility. But there's one other very good reason for becoming your own portfolio manager: The potential for better performance.

Many academic studies show that during both good and bad times the vast majority of Wall Street's portfolio managers consistently underperform versus corresponding benchmark indexes. However, making the decision to supervise your own investments won't necessarily guarantee better results. To avoid the same type of market underperformance that characterizes most of Wall Street, you'll need to build your investments on the right foundation. Click here for more details."

Friday, November 27, 2009

Using moving average to set stop

You may already have some decent paper profits on your portfolio and are wondering when you should take some profits before the recent mini bull turns around. This is where we can use the "Stop".

Most traders and market timers use percentage of the stock price anywhere from 5% to 15% to set their mental or hard stops. Here is another way of setting stops using moving averages.

With existing long position (short uses reverse method)

1. Sell half (1/2) when weekly MA-4 crosses below MA-18 (MA = Moving average)

2. Sell remaining 1/2 when MA-4 crosses below MA-39

If the price bounced back above the MA-18 line, I would buy back 1/2 of the long position when:

1. Weekly MA-4 is greater than 20% of MA-18 after MA-4 crossed above MA-18.

By buying back 1/2 of the position, one can continue to maximize the profits of the trending market despite a temporarily setback.

(click the chart to enlarge)

Most traders and market timers use percentage of the stock price anywhere from 5% to 15% to set their mental or hard stops. Here is another way of setting stops using moving averages.

With existing long position (short uses reverse method)

1. Sell half (1/2) when weekly MA-4 crosses below MA-18 (MA = Moving average)

2. Sell remaining 1/2 when MA-4 crosses below MA-39

If the price bounced back above the MA-18 line, I would buy back 1/2 of the long position when:

1. Weekly MA-4 is greater than 20% of MA-18 after MA-4 crossed above MA-18.

By buying back 1/2 of the position, one can continue to maximize the profits of the trending market despite a temporarily setback.

(click the chart to enlarge)

Wednesday, November 25, 2009

EWZ back testing using TradeStation

Here is another back testing using TradeStation

Symbol: EWZ

Weekly chart from: Jan 1, 2003 to Nov 25, 2009

Buy (all in): MA-4 crosses above MA-39 (white line crosses above cyan line)

Sell (all out): MA-4 crosses below MA-39 (white line crosses below cyan line)

Results:

Total of 5 buys, 4 sells with 3 wins, 1 loss and 1 unrealized profit

(Note: Simulation result is not a guarantee of future results)

(click the chart to enlarge)

Symbol: EWZ

Weekly chart from: Jan 1, 2003 to Nov 25, 2009

Buy (all in): MA-4 crosses above MA-39 (white line crosses above cyan line)

Sell (all out): MA-4 crosses below MA-39 (white line crosses below cyan line)

Results:

Total of 5 buys, 4 sells with 3 wins, 1 loss and 1 unrealized profit

(Note: Simulation result is not a guarantee of future results)

(click the chart to enlarge)

EFA back testing using TradeStation

Here is the simple computer simulation back testing using TradeStation platform.

Symbol: EFA

Weekly chart period from: Jan1, 2003 to Nov 25, 2009

Buy (all in): MA-4 crosses above MA-39 (white line crosses above cyan line)

Sell (all out): MA-4 crosses below MA-39 (white line crosses below cyan line)

Results:

Total of 4 buys, and 3 Sells

2 wins, 1 loss and 1 unrealized profit

(Note: Simulation result is not a guarantee of future results)

Symbol: EFA

Weekly chart period from: Jan1, 2003 to Nov 25, 2009

Buy (all in): MA-4 crosses above MA-39 (white line crosses above cyan line)

Sell (all out): MA-4 crosses below MA-39 (white line crosses below cyan line)

Results:

Total of 4 buys, and 3 Sells

2 wins, 1 loss and 1 unrealized profit

(Note: Simulation result is not a guarantee of future results)

Sunday, November 22, 2009

EFA - International Index Fund

EFA is one of the most popular ETF funds that provides global diversification among the index funds. It includes stocks from Europe, Australasia and the Far East. Based on Yahoo Finance next year's estimated EPS, the top 15 holdings' average forward P/E is 12.8 with biggest sector in Financial. In my opinion it is attractive at this level.

With market cap of $35,000M, average daily volume of 18M shares and dividend of 3.42%, the fund is well liquidated and ideal for short term trading and long term holding as growth and dividend play.

As for technical analysis using the moving average cross-over on the weekly chart, the MA-4 is over the MA-39 and there were many occurrences with weekly closing high since 5/22 when the cross-over began.

It seems that the fund still has more room on the up side. The next resistant level may be around $65 from last Friday close of $55.34. EFA may be the fund that can be categorized as a "must own" in my opinion for immediate-term and long-term play if you like to own some international index fund in your investment portfolio.

With market cap of $35,000M, average daily volume of 18M shares and dividend of 3.42%, the fund is well liquidated and ideal for short term trading and long term holding as growth and dividend play.

As for technical analysis using the moving average cross-over on the weekly chart, the MA-4 is over the MA-39 and there were many occurrences with weekly closing high since 5/22 when the cross-over began.

It seems that the fund still has more room on the up side. The next resistant level may be around $65 from last Friday close of $55.34. EFA may be the fund that can be categorized as a "must own" in my opinion for immediate-term and long-term play if you like to own some international index fund in your investment portfolio.

Harvard Endowment favors mix of International ETFs

International and Emerging Market ETFs are my favors ETFs in my investment portfolio. In my opinion, these markets will outperform the U.S. domestic markets in the years to come. These markets are already attracted by active institutions, investors and traders as it can be verified by its average daily trading volume.

Here is an interesting finding:

According to Yahoo's source (click here) from Tickerspy.com on Nov 19, 2009:

Though the market downturn was devastating for the Harvard endowment, 2009's extend rally has kept the more dire forecasts from being realized.

According to Bloomberg, the value of Harvard's investments fell by -27.3% in the year ended June 30, not as bad as the -30% decline that had been predicted and not as bad as the hits that other institutional investors took.

Though the endowment has substantial investments in alternative assets like real estate and private equity, investors can get a sense of Harvard's strategy by looking at its U.S.-listed, equity holdings. They turn out to be quite diversified, with an international bias that makes ample use of a variety of ETFs.

Looking at Harvard's top U.S.-listed holdings at the end of Q3, which were recently disclosed to the SEC, the largest U.S.-listed, equity holding by a wide margin was ETF iShares MSCI Emerging Markets Index (NYSE: EEM - News), where Harvard was adding its stake during the quarter.

Meanwhile, Harvard was upping its exposure to individual emerging and overseas markets via increased stakes in a variety of ETFs, including iShares FTSE/Xinhua China 25 Index (NYSE: FXI - News), iShares MSCI Brazil Index (NYSE: EWZ - News), iPath MSCI India Index ETN (NYSE: INP - News), iShares MSCI Taiwan Index (NYSE: EWT - News), iShares MSCI Malaysia Index (NYSE: EWM - News), and iShares MSCI South Africa Index (NYSE: EZA - News).

Here is an interesting finding:

According to Yahoo's source (click here) from Tickerspy.com on Nov 19, 2009:

Though the market downturn was devastating for the Harvard endowment, 2009's extend rally has kept the more dire forecasts from being realized.

According to Bloomberg, the value of Harvard's investments fell by -27.3% in the year ended June 30, not as bad as the -30% decline that had been predicted and not as bad as the hits that other institutional investors took.

Though the endowment has substantial investments in alternative assets like real estate and private equity, investors can get a sense of Harvard's strategy by looking at its U.S.-listed, equity holdings. They turn out to be quite diversified, with an international bias that makes ample use of a variety of ETFs.

Looking at Harvard's top U.S.-listed holdings at the end of Q3, which were recently disclosed to the SEC, the largest U.S.-listed, equity holding by a wide margin was ETF iShares MSCI Emerging Markets Index (NYSE: EEM - News), where Harvard was adding its stake during the quarter.

Meanwhile, Harvard was upping its exposure to individual emerging and overseas markets via increased stakes in a variety of ETFs, including iShares FTSE/Xinhua China 25 Index (NYSE: FXI - News), iShares MSCI Brazil Index (NYSE: EWZ - News), iPath MSCI India Index ETN (NYSE: INP - News), iShares MSCI Taiwan Index (NYSE: EWT - News), iShares MSCI Malaysia Index (NYSE: EWM - News), and iShares MSCI South Africa Index (NYSE: EZA - News).

SPY weekly chart of Nov 20, 2009

The S&P 500 ETF SPY weekly closing price continues to hover above the MA-18 and well above the MA-39 line. As the "V" shape is formed starting from near the end of 2007 to bottoming in mid March of 2008 and now steadily coming back to the current level. For trend following using the indicator, the general market seems to have momentum to move up to around $120 in about a month or two from Friday close of $109.43.

Is recovery stalling?

From Rex Nutting of MarketWatch:

Last week, a "reality check" rippled through the markets following weak data on housing starts and industrial production, said Nigel Gault and Brian Bethune, U.S. economists for IHS Global Insight. They expect further "mixed and somewhat ambiguous" reports in the coming week, but, on whole, they say "the evidence is still positive and continues to point to a nascent recovery" that will need "strong policy support" for some time.

Federal policies are clearly supporting the market, but there is uncertainty about how strong it would be without the support. Economists for Barclays Capital say that sales of existing homes would have risen 10% without the tax credit, instead of the 24% that has been recorded with it.

Economists see the economy growing at a pace just above its long-term trend. They expect GDP to grow 2.5% in the fourth quarter, 3% in the first quarter of 2010 and 3.5% in the second quarter. That's a far cry from the 6% growth seen in typical V-shaped recoveries, but it's better than a poke in the eye with a sharp stick. Of course, those are just forecasts. No one really knows for sure how the economy will do over the next 12 to 18 months. For more details, click here.

Last week, a "reality check" rippled through the markets following weak data on housing starts and industrial production, said Nigel Gault and Brian Bethune, U.S. economists for IHS Global Insight. They expect further "mixed and somewhat ambiguous" reports in the coming week, but, on whole, they say "the evidence is still positive and continues to point to a nascent recovery" that will need "strong policy support" for some time.

Federal policies are clearly supporting the market, but there is uncertainty about how strong it would be without the support. Economists for Barclays Capital say that sales of existing homes would have risen 10% without the tax credit, instead of the 24% that has been recorded with it.

Economists see the economy growing at a pace just above its long-term trend. They expect GDP to grow 2.5% in the fourth quarter, 3% in the first quarter of 2010 and 3.5% in the second quarter. That's a far cry from the 6% growth seen in typical V-shaped recoveries, but it's better than a poke in the eye with a sharp stick. Of course, those are just forecasts. No one really knows for sure how the economy will do over the next 12 to 18 months. For more details, click here.

Thursday, November 19, 2009

Sign of Moderate Recovery ?

There may be sign of moderate recovery. According to William Watts of MarketWatch.

"The world's developed nations are in line for a "moderate recovery" after the nastiest global downturn in decades, but the rebound won't be enough to stem rising unemployment until late next year or early 2011, the Organization for Economic Cooperation and Development said Thursday in its semi-annual economic outlook."

Click here for details

"The world's developed nations are in line for a "moderate recovery" after the nastiest global downturn in decades, but the rebound won't be enough to stem rising unemployment until late next year or early 2011, the Organization for Economic Cooperation and Development said Thursday in its semi-annual economic outlook."

Click here for details

Tuesday, November 17, 2009

Trader Portfolio created

The Trader Portfolio philosophy is speculative and focused on short-term trading. However, this is not a day trade strategy where transaction happens within the same day. The trend and momentum methodology is applied and it may use scale-in, scale-out to lock in profits or reduce losses.

It trades long and short positions and no more than 5 stocks or ETFs will be traded at any one time in order to maintain the focus. This strategy may not be suitable for most value investors but it can be a supplement strategy to their regular portfolio. It may be ideal for active traders who's time horizon is only from few weeks to few months.

I will test drive this strategy and see if it can produce a decent result with this virtual portfolio

It trades long and short positions and no more than 5 stocks or ETFs will be traded at any one time in order to maintain the focus. This strategy may not be suitable for most value investors but it can be a supplement strategy to their regular portfolio. It may be ideal for active traders who's time horizon is only from few weeks to few months.

I will test drive this strategy and see if it can produce a decent result with this virtual portfolio

Saturday, November 14, 2009

Investing philosophy of Ocean Portfolio

The investing philosophy of my fund is based on the trend following technique using technical indicators with discipline. The portfolio is to focus only on ETFs trading to seek its potential growth and profits as long as the selected fund remains in its trending direction.

When the trend reverses and reaches its predetermined criteria, the full or scale-out of the holding would be liquidated for either taking profits or reducing losses. Using this strategy may not achieve the maximum potential profits, but it protects the extended loss of the capital should the trending patterns reverse.

The major technical indicator for trend following is the Moving Average indicator and it is widely used by many successful investors. My ETF selection is divided in the following areas: Domestic, International, Emerging markets, Country specific and Sectors. Position can be either Long or Short (inverse) depends on the trend of the market. ETF that has at least over 1 million shares of average daily trading volume is considered for trading because liquidity is the key for market investment. The holding period of each fund can be days, weeks or months as long as the trending pattern holds.

The choice of investing in the ETFs using the trend following technique is to maintain the steady growth of the investment capital while keeping the loss to minimum and reducing the management expenses comparing to mutual funds.

One of the successful investment publication "The Mutual Fund Strategist" by Holly Hooper is using the similar moving average technique to advice its clients as it mentioned in her sample newsletter.

The Ivy Portfolio by Mebane Faber and his research paper also identified the moving average indicator can be a strategy of choice for discipline investors.

The ETF Trend Following Playbook by Tom Lydon also emphasized the similar technique and achieved great result.

The Simple Hedge Strategy created by Ulli Niemann who used his proprietary Trend Tracking Index (TTI) along with simple moving average and trend line resulted in great success.

Dick Fabian's 39-week moving average technique described from his book "The Mutual Fund Wealth Builder" which had a high percentage of making profits in a trending market. My Simple Moving Average Strategy of 39-week MA is based on his finding and I added the MA-4 cross-over for additional confirmation signal.

For some aggressive and swing position plays, daily and minute charts using these simply moving averages may be considered.

Two important rules, DISCIPLINE and TIME are the keys. Given a strategy that seems to be working, we need to adhere to it and provided ample of time to let it run and profits may come at the end.

When the trend reverses and reaches its predetermined criteria, the full or scale-out of the holding would be liquidated for either taking profits or reducing losses. Using this strategy may not achieve the maximum potential profits, but it protects the extended loss of the capital should the trending patterns reverse.

The major technical indicator for trend following is the Moving Average indicator and it is widely used by many successful investors. My ETF selection is divided in the following areas: Domestic, International, Emerging markets, Country specific and Sectors. Position can be either Long or Short (inverse) depends on the trend of the market. ETF that has at least over 1 million shares of average daily trading volume is considered for trading because liquidity is the key for market investment. The holding period of each fund can be days, weeks or months as long as the trending pattern holds.

The choice of investing in the ETFs using the trend following technique is to maintain the steady growth of the investment capital while keeping the loss to minimum and reducing the management expenses comparing to mutual funds.

One of the successful investment publication "The Mutual Fund Strategist" by Holly Hooper is using the similar moving average technique to advice its clients as it mentioned in her sample newsletter.

The Ivy Portfolio by Mebane Faber and his research paper also identified the moving average indicator can be a strategy of choice for discipline investors.

The ETF Trend Following Playbook by Tom Lydon also emphasized the similar technique and achieved great result.

The Simple Hedge Strategy created by Ulli Niemann who used his proprietary Trend Tracking Index (TTI) along with simple moving average and trend line resulted in great success.

Dick Fabian's 39-week moving average technique described from his book "The Mutual Fund Wealth Builder" which had a high percentage of making profits in a trending market. My Simple Moving Average Strategy of 39-week MA is based on his finding and I added the MA-4 cross-over for additional confirmation signal.

For some aggressive and swing position plays, daily and minute charts using these simply moving averages may be considered.

Two important rules, DISCIPLINE and TIME are the keys. Given a strategy that seems to be working, we need to adhere to it and provided ample of time to let it run and profits may come at the end.

Wednesday, November 11, 2009

Initial position in TSP Portfolio

I purchased 50% the the given virtual portfolio in 3 funds at KaChing.com

1. EFA = I fund (about 25%)

2. SPY = C fund (about 12.5%)

3. IWM (about 12.5%). IWM is Russell 2000 that replaced the VXF (S fund) for my purchase because the trading volume for VXF is small and did not meet my criteria that the daily volume needs to exceed 5 million shares for liquidity reason.

For future trading of S fund, the IWM will be used.

Ocean

1. EFA = I fund (about 25%)

2. SPY = C fund (about 12.5%)

3. IWM (about 12.5%). IWM is Russell 2000 that replaced the VXF (S fund) for my purchase because the trading volume for VXF is small and did not meet my criteria that the daily volume needs to exceed 5 million shares for liquidity reason.

For future trading of S fund, the IWM will be used.

Ocean

ETFs equivalent of the TSP Funds

1. Cash => G fund is the the short term non-marketable US Treasury securities issued to TSP G fund, the one TSP fund that guaranteed not to decrease in value. There are money market funds in mutual funds such as VMMXX and FDRXX. But my main focus is ETF equivalent and not in mutual funds. So "Cash" is chosen here.

2. AGG => F fund tracks investment-grade bonds traded in US

3. SPY => C fund tracks S&P 500

4. VXF => S fund tracks Wilshire 4500 Composite Index. There is no ETF equivalent to S. VXF is chosen because it tracks the S&P Completion Index and with similar tracking concept.

5. EFA => I fund tracks Morgan Stanley Capital International EAFE

In summary:

ETF funds will be:

Cash = G

AGG = F

SPY = C

VXF = S

EFA = I

2. AGG => F fund tracks investment-grade bonds traded in US

3. SPY => C fund tracks S&P 500

4. VXF => S fund tracks Wilshire 4500 Composite Index. There is no ETF equivalent to S. VXF is chosen because it tracks the S&P Completion Index and with similar tracking concept.

5. EFA => I fund tracks Morgan Stanley Capital International EAFE

In summary:

ETF funds will be:

Cash = G

AGG = F

SPY = C

VXF = S

EFA = I

Tracking Thrift Saving Plan (TSP)

I will include the Government retirement investments - Thrift Savings Plan (TSP) in this blog. Only government employees including military and civilian personnel can participate this plan as their retirement investment. TSP is equivalent to the 401K in the private sector. The growth of TSP balance under management is rapidly and cannot be ignored.

TSP is the main source of retirement income for retired government employees who are under the Federal Employees Retirement System (FERS). TSP can be considered as a supplement for retirees under the Civil Service Retirement System (CSRS) since their other retirement pension is higher.

There are 5 index funds and 5 Life Cycle funds which can be invested. I only focus on the 5 funds and not the 5 Life Cycle funds. The5 Life Cycle funds are the mixed of the 5 index funds depending on the investor's expected retirement year.

The 5 index funds I will focus are:

1. G: Government Securities Investment fund

2. F: Fixed Income Index Investment fund

3. C: Common Stock Index Investment fund

4. S: Small Capitalization Index Investment fund

5. I: International Stock Index Investment fund

The 5 funds listed here are not publicly traded in the open markets. I will list the ETF equivalent (or close to equivalent) in the next message for tracking purpose.

TSP is the main source of retirement income for retired government employees who are under the Federal Employees Retirement System (FERS). TSP can be considered as a supplement for retirees under the Civil Service Retirement System (CSRS) since their other retirement pension is higher.

There are 5 index funds and 5 Life Cycle funds which can be invested. I only focus on the 5 funds and not the 5 Life Cycle funds. The5 Life Cycle funds are the mixed of the 5 index funds depending on the investor's expected retirement year.

The 5 index funds I will focus are:

1. G: Government Securities Investment fund

2. F: Fixed Income Index Investment fund

3. C: Common Stock Index Investment fund

4. S: Small Capitalization Index Investment fund

5. I: International Stock Index Investment fund

The 5 funds listed here are not publicly traded in the open markets. I will list the ETF equivalent (or close to equivalent) in the next message for tracking purpose.

Tuesday, November 10, 2009

Second buy order at market open today

I placed the buy order at the market open today for the same 8 ETFs that I bought yesterday with the same amount of shares as yesterday. It should give me about 50% of the equity in the market.

Ocean

Ocean

Monday, November 9, 2009

DOW went up 204 points today with a buy order

All 8 selected ETFs were executed at market open today. I miscalculated the numbers, the total amount of purchase was about $2.5M instead of $5M that I previous mentioned. I will look at the next entry point to purchase another 25%. I believe the markets still have room to go up.

1. EFA bought 6800 at $56.02

2. EPP bought 6000 at $42.10

3. EWY bought 5600 at $45.30

4. EWZ bought 5000 at $75.72

5. FXI bought 5600 at $45.09

6. ILF bought 8100 at $46.85

7. RSX bought 8500 at $30.15

8. SPY bought 3500 at $107.97

Ocean

1. EFA bought 6800 at $56.02

2. EPP bought 6000 at $42.10

3. EWY bought 5600 at $45.30

4. EWZ bought 5000 at $75.72

5. FXI bought 5600 at $45.09

6. ILF bought 8100 at $46.85

7. RSX bought 8500 at $30.15

8. SPY bought 3500 at $107.97

Ocean

Sunday, November 8, 2009

Initiated buy order at open on Nov 9, 2009

As new member of KaChing.com with $10M virtual money, here is my buy "Long" order at the market open on Nov 9, 2009. The purchase will cost about 50% of the $10M portfolio. The buy "Long" decision is based on the Simple Moving Average of MA-4 moving above the MA-39 on the SPY weekly chart and it indicated that the general market is trending up.

1. SPY 3500 shares

2. EFA 6800 shares

3. EPP 6000 shares

4. RSX 8500 shares

5. EWY 5600 shares

6. EWZ 5000 shares

7. FXI 5600 shares

8. ILF 8100 shares

Ocean

1. SPY 3500 shares

2. EFA 6800 shares

3. EPP 6000 shares

4. RSX 8500 shares

5. EWY 5600 shares

6. EWZ 5000 shares

7. FXI 5600 shares

8. ILF 8100 shares

Ocean

Moving average strategy

I use Simple Moving Average (SMA) as the trend indicator for all ETFs. On a weekly chart, I use 3 SMA lines such as MA-4, MA-18 and MA-39 for SPY (S&P 500 ETF) in my trend analysis. The concept is not new with weekly price crosses 39-week moving average. It was widely published by Dick and Doug Fabian in their newsletter years ago. I found this technique is still accurate with merit. Also I found that some ETFs tend to trend in either direction more steady than others, the daily charts can be applied with some ETFs as an aggressive approach.

I modified slightly by using the 4-week MA instead of the price to smooth out the cross-over curve. Here are the basic rules that I would use in my analysis:

Buy signal:

1. MA-4 crosses above MA-39 (up trend confirmed, initiate a buy)

Sell signal:

1. MA-4 crosses below MA-18 (evident of down trend movement). I may reduce the size of the Long position to lock in some profits or minimize the loss.

2. MA-4 crosses below MA-39 (down trend confirmed, sell all existing position)

Of course, the rules mentioned above was just one of many technical analysis techniques and there are so many other techniques out there. Other additional indicators may be useful to confirm these signals such as MACD, RSI etc which I also use.

Daily charts can be applied with some ETFs which these ETFs tend to trend more steady that others. direction

Ocean

I modified slightly by using the 4-week MA instead of the price to smooth out the cross-over curve. Here are the basic rules that I would use in my analysis:

Buy signal:

1. MA-4 crosses above MA-39 (up trend confirmed, initiate a buy)

Sell signal:

1. MA-4 crosses below MA-18 (evident of down trend movement). I may reduce the size of the Long position to lock in some profits or minimize the loss.

2. MA-4 crosses below MA-39 (down trend confirmed, sell all existing position)

Of course, the rules mentioned above was just one of many technical analysis techniques and there are so many other techniques out there. Other additional indicators may be useful to confirm these signals such as MACD, RSI etc which I also use.

Daily charts can be applied with some ETFs which these ETFs tend to trend more steady that others. direction

Ocean

Day one on this blog

This blog is about the stock markets and it will focus on the Exchange Traded Fund (ETF). My strategy is to track the S&P 500 index trends as the main indicator and position each ETF that I am following depends on its trend, relative strength, and momentum. The holding period of a particular ETF can be days, weeks or months as long as the trading pattern holds.

I created the virtual portfolio yesterday called "Ocean Portfolio" in KaChing.com and initiated a buy "Long" order on 8 ETFs at the market open on Nov 9 using about 50% of the available "virtual" balance given by KaChing.

The S&P 500 has been trending up since late March this year and I believe it will continue to move up in the near term. So I hope these long positions can be hold for a little while.

Ocean

Subscribe to:

Posts (Atom)