Mebane Faber and Eric Richardson had published a book named "The Ivy Portfolio: How to invest like the top endowments and avoid bear markets". Even though the endowments of some top Ivy League schools were not doing so well in 2008, the strategy of using moving average described in the book has its merit and the strategy has been widely followed by others.

The strategy utilizes a 10-month Simple Moving Average or a 10-month Exponential Moving Average to determine if the underline equity a buy or a sell. At the end of each month, if the closing price of the selected equity is above the 10-M SMA or 10-M EMA, then this equity is a buy. Otherwise, if the price closes below these moving averages, it is a sell. It's that simple.

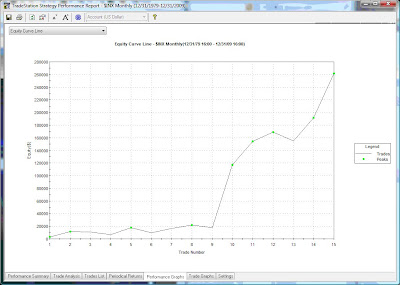

I ran a back-testing using TradeStation. Here were the setup and the result:

Setup:

1. Ticker: $INX - S&P 500

2. 10-M SMA

3. Duration: 1979 to Nov 2009 (30 years)

4. Position size: 200 shares

Result from TradeStation back-testing:

1. Total trades: 15

2. Number of winning trades: 10

3. Number of losing trades: 5

4. Percent Profitable: 66.67%

5. Total net profit: $261,800

This strategy works very well in my opinion if discipline can be enforced and not to worry about the daily and weekly price movement. It is worth for further investigation for you all.

(click the chart to enlarge)

No comments:

Post a Comment